Record results in 2017

The year 2017 was a breakthrough year for LOTOS Group when it comes to financial results.

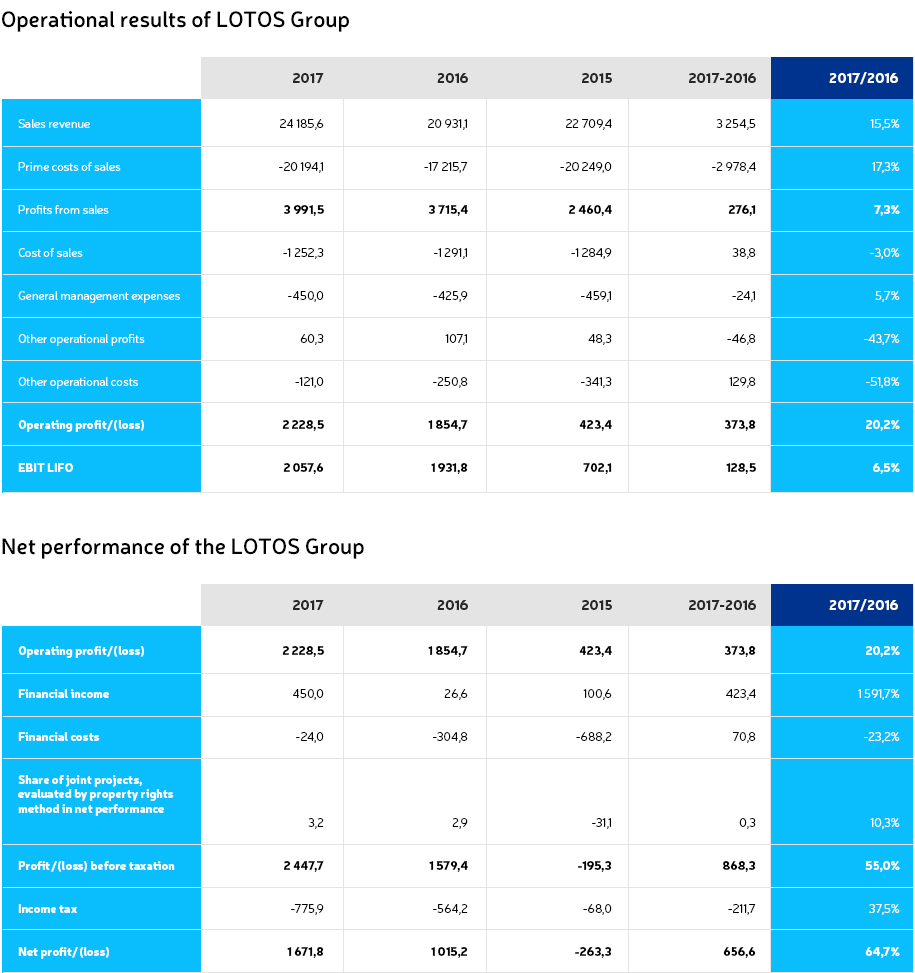

In the last year we have significantly improved our financial results, mainly with favorable prices of crude oil and petroleum products on world’s markets. Thanks to good economic situation the sales income of the LOTOS Group amounted to PLN 24.186 billion, that is a 15% increase compared to year 2016. Moreover, the consolidated nett profit reached historical level of PLN 1.7 billion, thus increasing by over 64% compared to the previous year.

We’re increasing power and constantly breaking our own records

The good financial results are an effect of consistent implementation of our business strategy “Stability and sustainable growth for years 2017-2022”. Among the most important activities in the series of actions carried out in the last year are, inter alia, diversification of sources of materials, realization of innovative projects, including research on biofuels of 2nd and 3rd generation, hydrogen technology and electromobility. Thanks to them we were able once more to close the financial year successfully and break the existing financial results records.

In 2017, the adjusted EBITDA (according to LIFO) amounted to the highest level in history of the company – PLN 3.1 billion. We are also proud of our, another record, adjusted EBITDA for the upstream segment, amounting to PLN 0.9 billion (so above the set objective of PLN 0.6-0.7 billion).

In the previous year we have generated over PLN 3.1 billion of cash flow in the business operation (compared to over PLN 2.6 billion in 2016, the growth equals 18%). Our diversified cash flow is guaranteed by, among others, 11*production fields (*onshore fields in Lithuania are treated as one source).

At the same time we have significantly reduced our debt, which at the end of 2017 has fallen

from PLN 4.8 billion to PLN 2.5 billion. The ratio of nett gearing to adjusted EBITDA according to LIFO amounted to 0.8x (in the previous year this ratio equaled to 1.9x).

The average model refining margin in year 2017 ran at the level of 7.54. In 2017, the average margin increased by 8.8%, compared to year 2016.

The detailed financial data for year 2017 are available HERE

For the first time in a decade we have distributed a dividend

On 14 June 2017, the General Meeting of Shareholders of Grupa LOTOS S.A. adopted a resolution on distribution of the Company’s profit for the year 2016, deciding to allot PLN 184.9 million

for the payment of dividend to its Shareholders. The amount of dividend per share amounted to PLN 1 gross.

Thus, after 12 years of presence on the Warsaw Stock Exchange, we have distributed a dividend to our shareholders for the second time in history. The allotted funds account for 18% of our nett profit. The previous dividend was distributed 10 years ago and it amounted to PLN 0.36 per share.

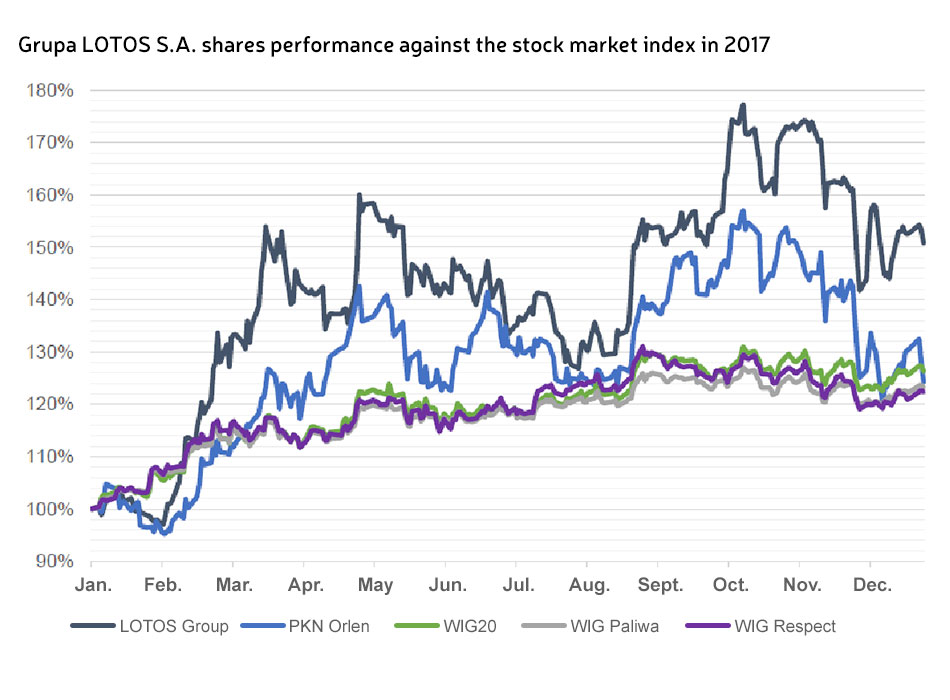

The shares of Grupa LOTOS S.A. have been listed on the Warsaw Stock Exchange since 9 June 2005. In 2017, the target price of Grupa LOTOS S.A. shares estimated by brokers ranged from PLN 34.27 – 84.5 compared to PLN 24.0 – 41.2 in the previous year. The shares of Grupa LOTOS S.A. in 2017 were measured on average at the level of PLN 59.59 compared to PLN 31.26 in the previous year. The market-based measure for Grupa LOTOS S.A. shares ranged from PLN 37.0 – 68.85. The share closing price on the last trading day of year 2017 amounted to PLN 57.7.

In 2017, there were 26 broker recommendations, including:

• 9 BUY recommendations

• 2 ACCUMULATE recommendations

• 9 HOLD recommendations

• 1 NEUTRAL recommendations

• 2 REDUCE recommendations

• 3 SELL recommendations

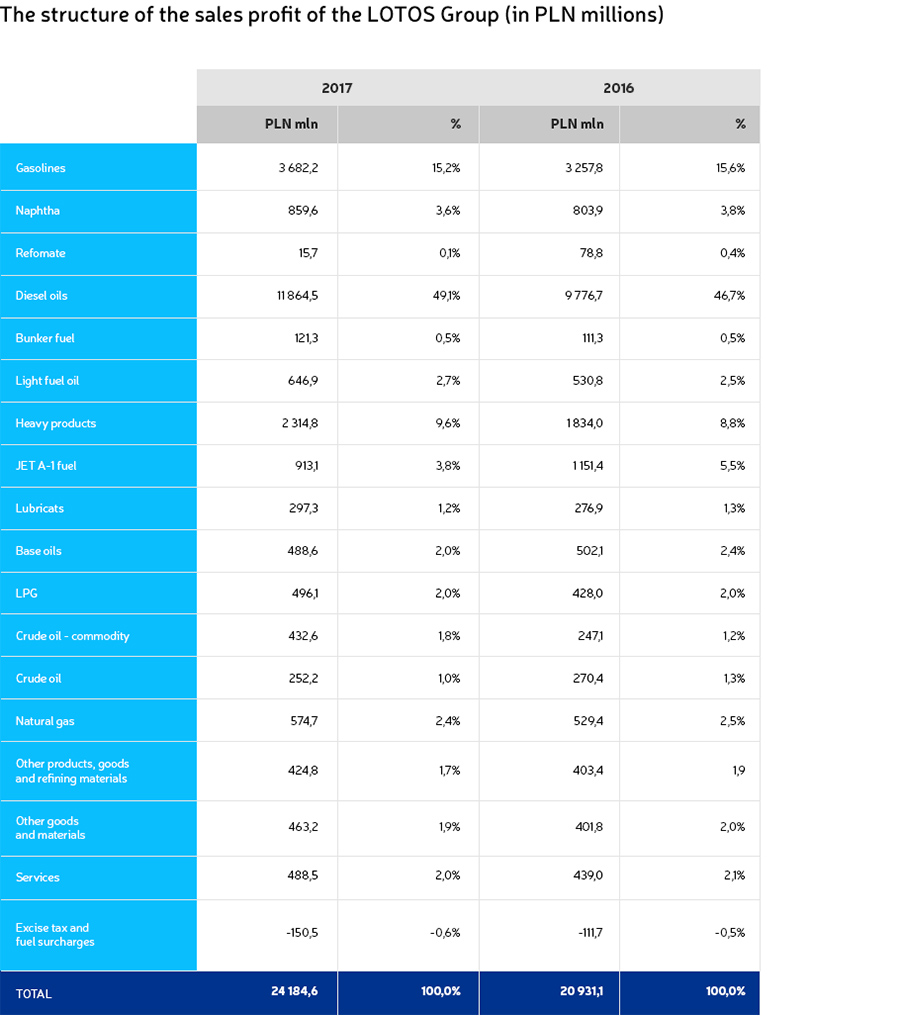

Sales and distribution – we focus on efficiency

In 2017, the downstream segment of LOTOS Group sold 10.9 million tons of products. The expenditures for purchasing of raw materials as well as petroleum merchandise and materials amounted to PLN 17.6 billion. The EBIT of the downstream segment before depreciation and amortisation, excluding the non-cash allowances (adjusted EBITDA LIFO) amounted to PLN 2.2 billion (in this scope the retail reached the level of PLN 0.2 billion)

Our share in the domestic fuel market in year 2017 amounted to 31.6% – a 2.1% increase compared to the previous year.

We have increased not only the market share but also the domestic sales – 19% more compared to year 2016. For the second year running we can be also proud of the fact that the aviation fuel sales also grew – by 42% in year 2017.

We also recorded high results in the average daily fuel sales dynamics – compared to the average dynamics of other concerns the dynamics of LOTOS was 26% higher.

Moreover, the sales of non-fuel articles and services also increased (by 14%), while the margin increased by 23%.

16.3% of the raw materials as well as petroleum merchandise and materials purchase by the LOTOS Group in year 2017 was domestic (decrease by 0.6 percentage point, compared to year 2016).

| Consolidated nett sale | ||

| Gasolines | PLN millions | 6,618.0 |

| Naphtha | PLN millions | 859.6 |

| Reformate | PLN millions | 15.7 |

| Diesel oils | PLN millions | 20,541.8 |

| Bunker fuel | PLN millions | 121.6 |

| Light fuel oil | PLN millions | 721.1 |

| JET A-1 fuel | PLN millions | 913.1 |

| Lubricants | PLN millions | 315.9 |

| Base oils | PLN millions | 488.7 |

| Heavy products * | PLN millions | 2,315.7 |

| LPG | PLN millions | 588.1 |

| Crude oil | PLN millions | 252.2 |

| Crude oil – commodity | PLN millions | 432.6 |

| Natural gas | PLN millions | 574.4 |

| Other products, goods and refining materials | PLN millions | 425.2 |

| Other goods and materials | PLN millions | 463.5 |

| Services | PLN millions | 488.8 |

| Other adjustments and corrections** | PLN millions | -150.5 |

| Excise tax and fuel surcharges | PLN millions | -11,799.9 |

More about our results in Sales and distribution segment HERE

Investment in the future

Being aware of the developments on the worldwide fuel markets, new laws and regulations adopted as well as because of the need to be competitive, we are consistent in improving our offer and processes supporting our activities in every segment and on every level of our organisation.

In 2017, the LOTOS Group incurred investment expenditures in the amount of PLN 1,445 million, of which the largest part were expenditures related to the project of delayed coking unit (EFRA project), crude oil and natural gas extraction, mainly B8 deposit in the Baltic Sea, and also the production in the Sleipner and Heimdal fields in Norway. We also invested in the purchase of catalysts and components, expansion and modernization of the petrol station network, as well as the construction of the Hydrogen Recovery Unit (WOW) installation, which will allow the use of renewable energy sources in refinery processes.

To optimize extraction and to take care as much as possible for the energy security, we have invested in exploration and recognition of fields. Capital expenditures in the upstream segment in 2017 amounted to PLN 380.1 million.

We fuel Polish economy

As the second largest oil company in Poland, we are aware of the impact we are exerting

on the economy of our country.

Positive impact on the development of the country and local communities, where we operate, have, among others, the taxes we pay.

| in PLN million | |

| Fares and charges (country breakdown) | 2017 |

| Poland | 469.0 |

| Norway | 26.2 |

| Lithuania | 11.4 |

| Summed up | 506.6 |

The operations of LOTOS affect the economies of countries in which the company conducts its operations also through a diversified network of suppliers. We support primarily the local entrepreneurs, improving development conditions for small and medium business. An important role in exerting a positive economic impact is played by one of our companies – LOTOS Oil. It cooperates with numerous local suppliers of goods and services for whom establishing business relationships with the LOTOS brand is an unquestionable opportunity for growth. This is also reflected in the creation of more jobs in the regions in which these enterprises operate.

Good practice of Grupa LOTOS S.A. – we support local suppliers

In 2017, we allocated PLN 5223 million for services provided by local companies from Gdańsk and the surrounding area, which accounts for 25% of the purchase budget of Grupa LOTOS S.A..

We are a significant employer not only in Pomerania, but thanks to the network of our petrol stations, also in other parts of the country. We employ a total of 4897 employees at the LOTOS Group. In respect of the employment in 2017, we paid PLN 736.2 million in employee benefits.

Money paid to our employees and suppliers contributes indirectly to improving the economic situation of the regions in which we operate. Their financial turnover supports other local enterprises and improves the quality of life of local communities.

| the ratio of standard entry level wage by gender compared to the local minimum wage at significant locations of operation |

Poland |

| average entry level remuneration in the LOTOS Group | 2440 |

| minimum wage in a given country | 2100 |

With our wide range of products we are also trying to eliminate restrictions in access to consumer goods for citizens having a low income. The LOTOS Oil products are easily available and

in various price levels, what allows access for a wide range of recipients – both those affluent and those of lower income.

Within the LOTOS Group we also conduct a number of innovative and pro-efficiency activities that reduce the costs of processes and energy. In this way, we try to minimize the negative global trend of price growth of energy factors and, consequently, counteract energy poverty.